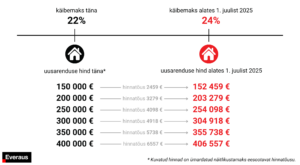

If you’ve been dreaming of a new home, now is the best time to act — because in July 2025, Estonia’s VAT will increase from 22% to 24%. VAT is a consumption tax, meaning it is automatically added to the price of goods or services at the applicable rate and paid by the consumer. In other words, from July 1st, 2025, property prices will rise.

So, if you purchase a completed home before July 1st, 2025, you will save on the VAT increase. The money you save can be invested in furnishing your home or used for other important expenses.

Please note: if you buy a home today that will be completed after July 1st, 2025, the portion of the purchase price paid upon completion will be subject to the new VAT rate. That means you’ll have to pay more than originally agreed due to the tax rate increase.