One of Estonia’s largest real estate developers, Everaus Kinnisvara AS, launched the public offering of the second tranche of its bond programme on 8. October. The total value of the offering is up to 3 million euros. The nominal value of one bond is 1000 euros and the redemption date is 22. October 2028. The bonds carry a fixed annual interest rate of 10%, with interest payments made quarterly. The subscription period will end on 17. October.

Everaus Kinnisvara AS launched its first public bond offering in May of this year, issuing 5000 bonds with a total value of 5 million euros under the first tranche of its bond programme. The issued bonds are traded on the alternative market First North of Nasdaq Tallinn.

The funds raised through the first tranche have been used as intended, enabling steady progress in the Company’s real estate development projects. In Kindluse Kodu phase I (townhouses and semi-detached houses), infrastructure has been completed and the first buildings have reached full height (50% of the homes in phase I have been sold). In Luige Kodud phase II (townhouses and apartment buildings), construction has advanced to façade works and interior installations (30% of the homes in phase II have been sold). The construction of the second phase of the Lennuradari warehouse complex and the Haabersti self-storage facilities is in its final stage, with the new commercial buildings in the company’s rental portfolio – ensuring stable cash flow – scheduled for completion by the end of this year.

“The more than threefold oversubscription of our first bond offering in spring confirmed that we are recognised and valued not only by our clients and partners, but also by investors who trust our growth prospects and our strategy to develop high-quality and sustainable living and business environments. The second tranche offering provides an opportunity to further broaden the company’s investor community,” said Janar Muttik, Founder and Chief Executive Officer of Everaus Kinnisvara

More information about the second tranche of the bond programme offering is available on the company’s website and Nasdaq Tallinn website.

What Sets Everaus Kinnisvara Apart from Other Developers from an Investor’s Perspective?

Founded in 2015 as a private housing developer, the company has grown over the past decade into one of the most diversified developers in Estonia. A diversified portfolio provides a competitive advantage, strengthening the company’s resilience against market risks.

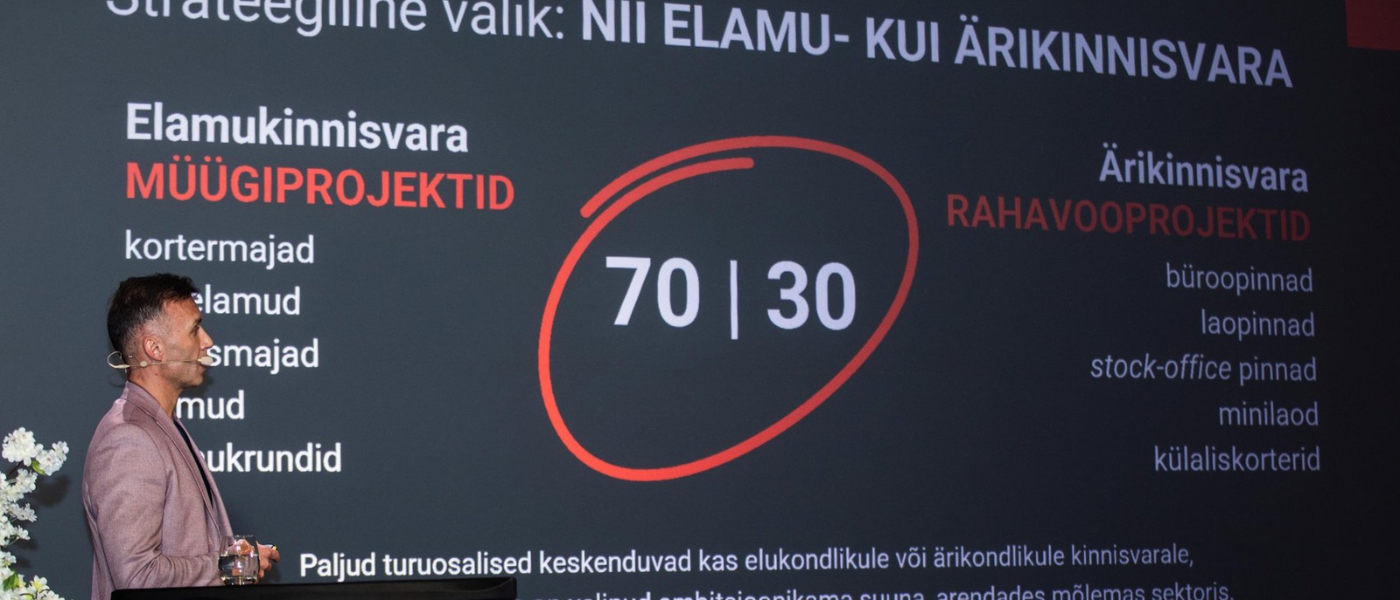

“Many market participants focus either on residential or on commercial real estate, while Everaus Kinnisvara has chosen a more ambitious path by developing in both sectors. While residential projects are developed for sale, commercial real estate is developed as cashflow generating projects for rental purposes, with the completed buildings retained in our ownership to diversify risk,” commented Muttik, adding that this year three new commercial buildings will be added to the company’s rental portfolio – two buildings with a total of 64 warehouse and stock-office units, as well as a new self-storage complex with 342 storage units.

With the opening of the Haabersti self-storage complex at the end of this year, Everaus Kinnisvara will become the largest self-storage service provider in the Baltics. “When we entered the self-storage market in 2021, our aim was to break away from the outdated image of damp and dark basement units and to provide a modern storage solution aligned with the sector’s technological advancements for those lacking sufficient storage space at home or in the office. Our first self-storage complex with 335 units in Peetri has been well received, and in Haabersti – a district with a rapidly growing population – the opening of the new complex is eagerly awaited. A warm, secure storage space with 24/7 access offers the best solution to the permanent or temporary space shortage faced not only by local residents but also by small businesses,” commented Muttik.

Everaus Kinnisvara’s strength in terms of market risk also lies in the diversity of its development projects within the sector. While several large developers have positioned themselves exclusively as apartment building developers or have excluded private housing from their strategy, Everaus Kinnisvara’s portfolio includes apartment buildings, townhouses, semi-detached houses and single-family homes, as well as office buildings, warehouses, stock-office premises and self-storage facilities, in addition to residential plots and guest apartments.

“Different real estate segments perform differently over the course of economic cycles. When the residential market slows down, the commercial property sector – such as warehouses – can continue to perform strongly, driven by the growth of e-commerce and logistics demand. This enables us to offset lower income in one segment with growth in another,” explained Muttik, adding: “The diversity of our projects also allows us to reallocate capital flexibly, investing in the most profitable projects at any given time. When the apartment market experienced a downturn, our premium-class residential projects and private plots, which are less affected by market fluctuations, provided us with a significant advantage. Such strategy ensures sustainability and growth even when one or another market segment is in decline.”

Strong Growth and Value Proposition

Everaus Kinnisvara has established communities across more than 30 hectares and is currently developing integrated living and business environments on an additional 70 hectares. The Company operates in Estonia, primarily in Harju County, while expanding southward into Tartu County and Latvia.

Everaus Kinnisvara has emerged as one of the fastest-growing real estate development companies in Estonia. Its residential portfolio includes seven housing projects with more than 600 units, of which nearly 200 are currently under development. The commercial real estate portfolio comprises over 80 000 sqm of space, of which 15 000 sqm is either completed and fully leased or nearing completion. The scale and number of projects under development reflect the company’s capacity for long-term growth.

A strong focus on energy efficiency, design and comprehensively planned environments has attracted broad attention from both homebuyers and investors. Commitment to high standards provides a solid foundation for long-term success, strong customer loyalty, and high credibility in the eyes of investors and other partners. The Company is a pioneer and trendsetter, and the only real estate developer in Estonia whose nearly all completed residential projects have received high recognition in national housing competitions. Due to its forward-looking choices, the Company’s developments have repeatedly been awarded the title of “first of its kind.”

“For us, it is not only about developing real estate but about shaping environments where people genuinely want to live and work. Raising capital through bonds enables us to further expand this positive impact,” commented Mr. Muttik.

The purpose of the second tranche is to provide additional financing for the construction of subsequent stages of ongoing developments and for the initiation of new projects. Construction has commenced on the infrastructure for the next phases of Kindluse Kodu, on the houses of Luige Kodud phase III – the final stage of the project consisting of townhouses – as well as on the last two buildings of the Lennuradari warehouse complex. Preparations are also underway for the development of Kangru Kodu townhouses and for the launch of apartment buildings located on the outskirts of Tartu, which have recently been added to the company’s portfolio.

Strong Capital Management and a Long-Term Perspective

„Although this year marks our first bond issuance, we have long-standing experience in raising capital through cooperation with various private and institutional partners. Real estate development is capital-intensive and requires a long-term investment horizon. Bonds are one of the possible financing instruments for funding such large-scale projects,” explained Muttik.

Listen what Janar Muttik talked about real estate development capital structures in Äripäeva radio (from minute 21).

The year 2024 was one of significant growth and financial strengthening for Everaus Kinnisvara. The consolidated audited sales revenue for 2024 amounted to EUR 14.6 million, representing an increase of 182% compared to the previous year. The revenue growth was primarily driven by the sale of residential real estate units. The consolidated audited net profit for 2024 was EUR 2.9 million. The Group’s total assets amounted to EUR 45.6 million, up 51% compared to the previous year. The increase in equity demonstrates strong profitability and a sustainable capital structure.

The first half of 2025 has progressed in line with forecasts. This year is a capital-intensive development year for Everaus Kinnisvara, during which no major residential projects will be completed. As a result, sales revenue has been minimal: consolidated sales revenue for the first half of 2025 amounted to 3.9 million euros, representing approximately 50% of the forecast annual revenue. Net profit for the first half-year was 0.1 million euros, in line with expectations that 2025 will remain marginal in terms of profitability.

“The year has been developing positively. A new growth cycle has begun in the real estate market, but the sector and the demand for residential property will continue to depend on external factors, in particular interest rates, geopolitics, the tax environment and consumer confidence. Expectations remain that improvements in interest rates and real wages will continue, supporting the growth of housing affordability. However, tax policy and persistently high inflation continue to slow improvements in affordability. The latest economic forecast from the Bank of Estonia, projecting economic growth of over 3% from 2026 onwards, gives reason to remain optimistic about the years ahead,” commented Mr. Muttik.

Pikaajalist vaadet silmas pidades valmistub Everaus Kinnisvara turu uueks tõusulaineks arendustegevuses, kuid seda ka korporatiivsel tasandil, laiendades Everaus Kinnisvara juhatuse koosseisu ühelt liikmelt kolmele. Ettevõtte juhatuses jätkab asutajaliige Janar Muttik, kelle kõrval asuvad juhatuse liikme ülesandeid täitma ettevõttes arendusjuhina töötav Kaur Kaasikmäe ja finantsjuhina tegev Janika Roots.

„Uued juhatuse liikmed toovad ettevõtte juhtimisse uusi teadmisi ja kogemusi, mis aitavad tõhusamalt hallata ettevõtte kasvanud mahtu ning tagada kõrgtasemel juhtimiskvaliteedi ja -võimekuse. Laienenud juhatuse koosseisuga võtab Everaus Kinnisvara fookusesse protsesside tõhustamise, riskide tasakaalustatud juhtimise ja kvaliteedistandardite hoidmise, et toetada ettevõtte pikaajalist kasvustrateegiat ning suurendada väärtust klientidele, investoritele ja koostööpartneritele,“ kommenteeris Janar Muttik.

In cooperation with Investor Toomas, a platform created by Äripäev, a seminar introducing Everaus Kinnisvara and its bond issue took place on May 20 at Pihlaka Farm in Peetri. The recording of the seminar provides an overview of Everaus Kinnisvara’s operations, completed and ongoing projects, future plans, as well as the bond issue and its objectives. In addition to Everaus Kinnisvara’s founder and CEO Janar Muttik, CFO Janika Roots, and Supervisory Board member Ranol Kaseväli, the stage also featured Redgate Capital AS partner Valeria Kiisk and investor Lev Dolgatsjov, who holds the title of Investor of the Year. They shared their insights and experiences related to bonds. The event was moderated by Juhan Lang.

The seminar can be watched with English subtitles here. Please note that this is a seminar that took place on spring. An overview of the recent developments can be found in the Information Document (pages 7-9).

Investing in Everaus Kinnisvara is more than a financial decision – it is a contribution to the development of a sustainable and high-quality living and business environment.

Read the terms and conditions of the 2nd series of the bond offering here.

Redgate Capital AS and law firm TRINITI are advising on the organization of the issue.

Important information: This is an advertisement. Any investment decision in Everaus Kinnisvara AS bonds should be based on the company description and bond terms, which are not previously checked or approved by the financial supervision (available at: www.everaus.ee and www.nasdaqbaltic.com). The information in the advertisement is not an offer of securities. The listing of the bond on the Nasdaq Tallinn First North multilateral trading system does not constitute a recommendation to invest in the bonds.

Additional information: Janika Roots, Chief Financial Officer of Everaus Kinnisvara AS, investorid@everaus.ee.